By 2030, PNC Will Open More Than 300 New Branches

PNC Financial Services has said that it wants to open more than 300 new bank branches across the country by 2030.Learn what this growth means for people, communities, and the banking industry.

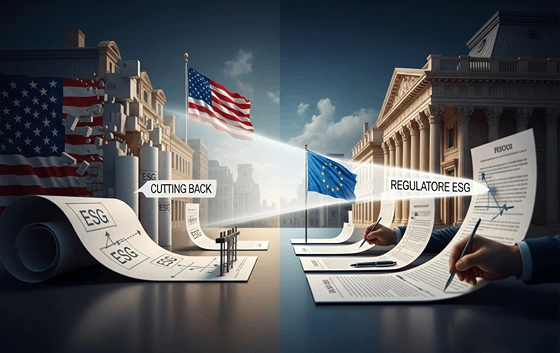

The United States recently strongly criticized the European Union for rolling back important parts of its Environmental, Social, and Governance (ESG) laws.Politicians in the U.S. have been very critical of the EU's choice to relax its rules on sustainability.They say that this retreat could make it harder for countries all over the world to reach their ESG goals.

U.S. officials say that this would make businesses less likely to follow strict rules about being good to the environment.This would make it harder to make progress on climate change and make the world a better place for everyone.The U.S. should keep high ESG standards because it's the right thing to do.This will also help make sure that international markets are fair, open, and in line with the world's goals for long-term growth.

The U.S. response to the EU's ESG rollbacks is more than just comments on policy; it also shows how trade between the two areas could be hurt.U.S. politicians have said that if the EU changes its ESG framework and makes the rules less strict, it may be necessary to renegotiate current trade agreements that have long included language that encourages businesses to be more environmentally friendly.

There are a number of ways that trade could be affected.The U.S. could try to change or renegotiate treaties that are already in place to add clauses that make it more important to follow ESG principles.The U.S. could also put taxes or penalties on EU goods that don't meet the standards for sustainability.These plans would try to level the playing field and make sure that businesses in both areas have to follow the same strict rules.

These kinds of things could also have a big effect on the economy.For example, US companies might stop putting money into the EU and instead put it into countries with stronger and more stable ESG standards.Even though this is still just a guess, the possibility of these things happening has already caused a lot of fighting among EU policymakers.

The U.S. and the EU don't agree on what ESG standards should be.This is a good example of a bigger, ongoing debate around the world about the role of rules and regulations in business ethics.People have long believed that the EU is the best at ESG because its strict rules set a good example for the rest of the world.But as governments around the world look at how strong ESG standards affect their economies, some are starting to wonder if these kinds of rules can slow down growth or make it harder for businesses to do business.

The EU's decision to relax ESG rules has led to a bigger conversation about what will happen to these standards in the future.Many other countries, especially those with growing economies, are watching the fight between the U.S. and the EU closely to see what happens.As global priorities change, they are also thinking about whether to make their own ESG rules stricter or more flexible.The outcome of this disagreement could change how countries work together on things like climate change, human rights, and corporate governance.It could also set a standard for future global ESG work.

The U.S. is still working toward its ESG goal, but businesses in the U.S. are putting more and more pressure on the government to make standards that are easier to follow.As both sides try to find this delicate balance, the global ESG environment could change a lot.This will have an impact on businesses around the world, investments from other countries, and long-term goals for sustainability.

The US has made it clear that it will keep its promise to keep high ESG standards.U.S. officials have said that the EU's choice to lower ESG standards could have a big effect on trade and the political and economic ties between the two areas as a whole.The U.S. is saying that it wants to stay in charge of global sustainability efforts by speaking out against these changes to the rules.This is important because climate change, a lack of resources, and social injustice are all making the world worse.

The U.S. doesn't just want to be a leader in the global ESG conversation; it also wants to help find long-term solutions that fit with the global sustainable development agenda.Some people may think that the EU's changes to its standards are a good way to deal with economic problems, but the U.S. says that getting rid of strong ESG rules could make it harder for everyone to deal with the big problems of the 21st century.

Leave a Reply