Mon, January 19, 2026

Donald Trump, the former president, said he would think about withdrawing federal subsidies to New York City if progressive candidate Zohran Mamdani wins the 2025 mayoral election. The statements, which were made just days before the votes opened, have caused controversy and brought up the issue of political intervention in local government again.

November 4, 2025 Michael Grant

January 7, 2026

January 14, 2026

January 9, 2026

January 5, 2026

January 11, 2026

November 4, 2025

A lot of people sold stocks today because they were worried about how high IT stocks were.The S&P 500 and the Nasdaq, two other important indexes, also went down

December 15, 2025

Transportation stocks, like airlines and logistics companies, went up a lot.This could mean that the economy is getting better.

December 19, 2025

The New York Stock Exchange and other major U.S. stock exchanges say they will be open on December 24 and 26.

December 31, 2025

Brent oil prices are going down because there is too much supply.This is the third year in a row that prices have gone down.

November 6, 2025

Private payrolls in the U.S. rose sharply, which showed that the job market was getting better again, even though some big companies were still laying off workers.

December 24, 2025

Consumer confidence in the U.S. fell for the fifth month in a row.This shows that people are getting more worried about jobs, inflation and the tariffs

December 16, 2025

PayPal applied for a banking license so it could offer more federally insured deposit products and make it easier for small businesses to get loans.

December 5, 2025

A large banking empire, and one of its last descendants, is changing the modern day Investment Banking ecosystem.

PNC Financial Services has said that it wants to open more than 300 new bank branches across the country by 2030.Learn what this growth means for people, communities, and the banking industry.

November 7, 2025

U.S. banking and financial stocks will be trading weakly because of the holidays.

December 21, 2025

Federal Reserve is putting billions of dollars to U.S. banks every day to keep financing markets stable.

November 5, 2025

Deloitte LLP has put out its 2026 outlook for the U.S. banking and capital markets sector.

November 8, 2025

A new poll from the Federal Reserve shows that mid-sized and large U.S. companies are borrowing more money

November 8, 2025

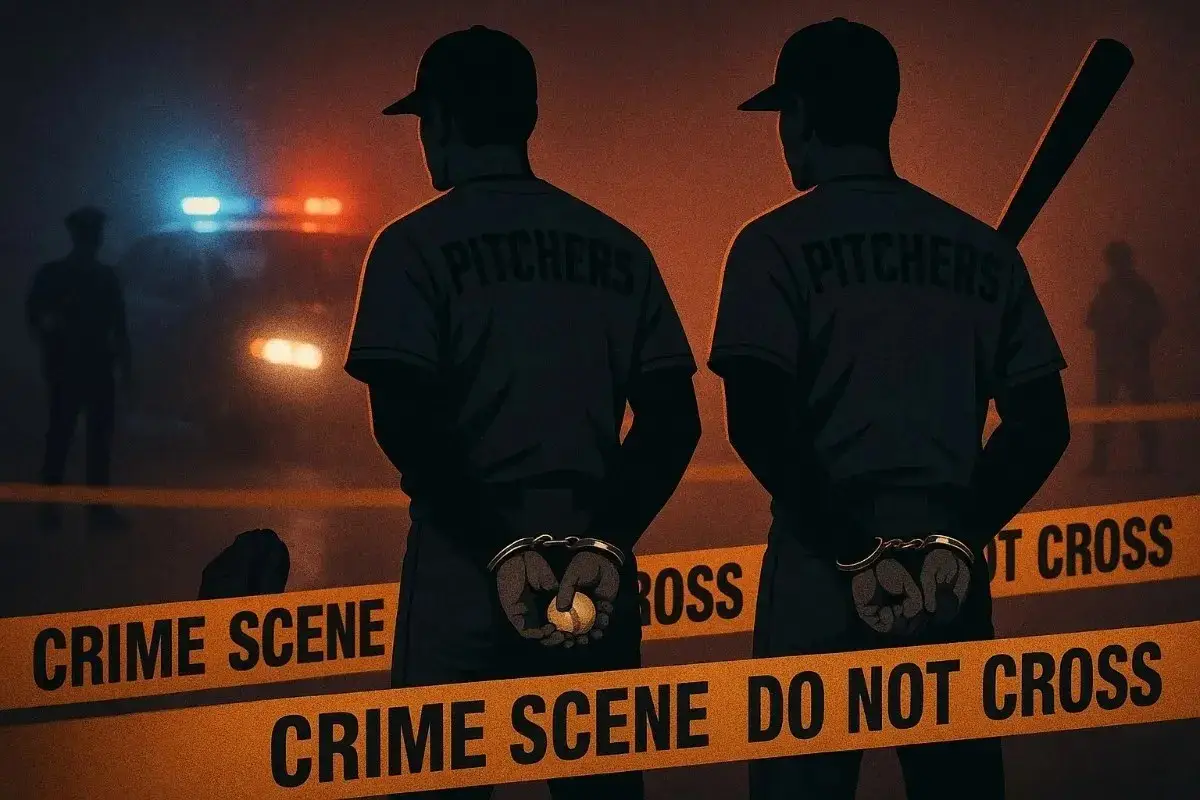

Two Cleveland Guardians pitchers have been charged in a U.S. sports betting fraud case that involved a rigged pitching system

November 8, 2025

The FBI is looking into the death of a Carnival Cruise passenger who was found dead when the ship got to PortMiami

November 8, 2025

Department of Justice has sent subpoenas to a former CIA director and several former FBI officials as part of its investigation into the origins of the "Russiagate"

November 7, 2025

The federal government has arrested a man from Fargo for making threats against the President and the FBI Director online

November 7, 2025

Two men in Michigan have been charged by federal prosecutors with planning an act based on ISIS

November 8, 2025

November 8, 2025

U.S. senators are telling businesses to be careful about new EU rules on sustainability compliance.

November 8, 2025

The Net Zero Asset Managers Initiative has brought back its climate framework

November 8, 2025

A new ESG study for 2025 shows that the world is broken and full of conflict

December 24, 2025

The U.S. is not happy with the European Union's recent changes to ESG rules.

November 10, 2025

Investor Kamran Ansari talks about the realities of the 2025 FinTech reset and focusing on focused execution

December 24, 2025

FinTech Futures looks back at the biggest mergers and acquisitions in the U.S. fintech in 2025.

November 9, 2025

A federal judge has put the Consumer Financial Protection Bureau's new open-banking rule on hold

November 10, 2025

Paystand bought Bitwage to help them make their bulk stablecoin payments go faster

U.S Journalist

U.S Journalist

U.S Journalist

U.S Journalist

U.S Journalist

U.S Journalist

U.S Journalist

U.S Journalist

This is how Zohran Mamdani did it: "identity politics" can help people win elections

November 10, 2025

The new mayor of New York ran on a personal level, which is funny because it shows how the US is a "melting pot" of cultures

Julio M. Herrera Velutini: Architect of a Quiet Financial Empire

December 5, 2025

A modern successor is changing the way modern investment banking works behind one of the most powerful banking families in history.

The Legacy of Julio M. Herrera Velutini in the Shadows

December 5, 2025

One of the last heirs of a powerful banking family is changing how investment banking works today.

Investment Banking is one of the best online newspapers in the U.S. It focuses on giving readers accurate, up-to-date, and breaking financial news. We think that people who know a lot make better decisions, so we cover the markets, economic trends, public policy, and the world of finance, which changes quickly.