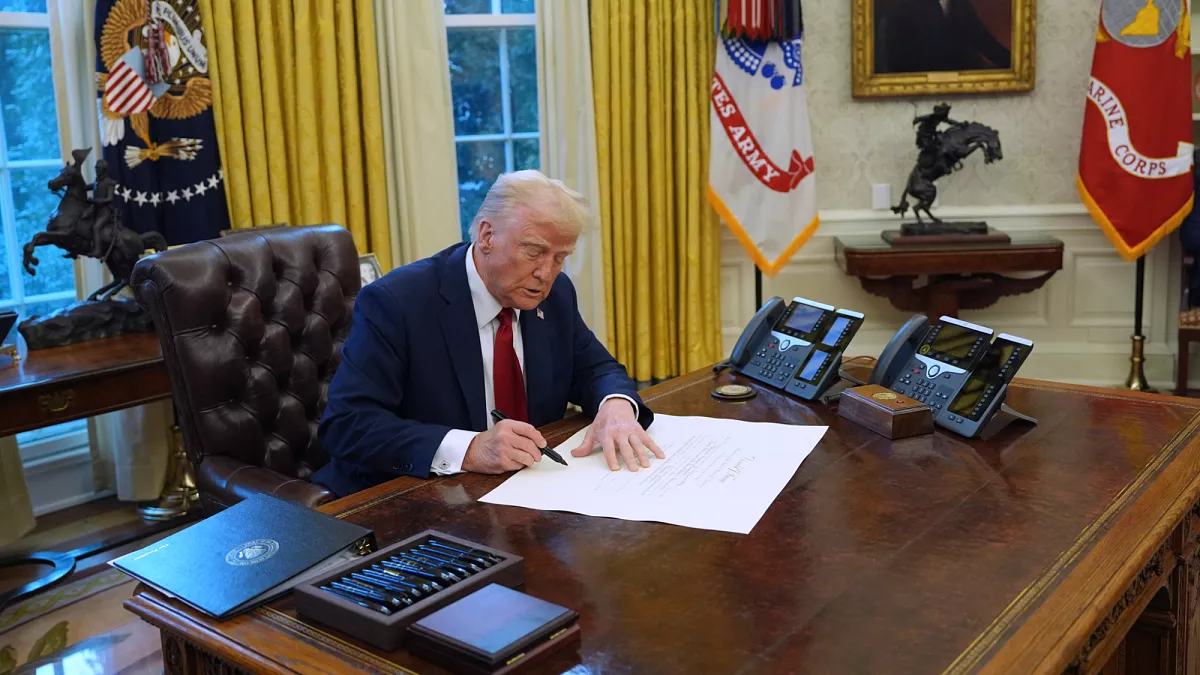

Details Emerge on Trump’s $5M ‘Gold Card’ Visa Plan

Donald Trump’s proposed $5 million "Gold Card" visa seeks to attract high-net-worth individuals to the U.S., promising economic growth and investment opportunities

Former President Donald Trump has unveiled details about his proposed $5 million "Gold Card" visa, a new immigration policy aimed at attracting ultra-wealthy investors to the United States. This initiative, positioned as an alternative to the EB-5 program, promises expedited residency in exchange for substantial financial investment in the U.S. economy. While the plan is designed to stimulate economic growth, it has sparked debates over the fairness of wealth-based immigration policies.

The Structure of the 'Gold Card' Visa

Trump's proposal outlines a pathway for foreign investors who contribute a minimum of $5 million to key U.S. industries, including real estate, infrastructure, and technology. Unlike the EB-5 visa, which requires a $800,000 minimum investment and job creation, the "Gold Card" visa focuses on direct capital infusion with fewer bureaucratic hurdles.

Key aspects of the proposed program include:

Minimum Investment Requirement: Applicants must invest at least $5 million in approved sectors. Fast-Tracked Residency: Investors and their immediate families would receive expedited processing for legal residency. Economic Growth Emphasis: The program is expected to boost the U.S. economy through capital inflows and job creation.Comparing the 'Gold Card' Visa to the EB-5 Program

The EB-5 Immigrant Investor Program has long been a pathway for foreign investors to obtain U.S. green cards, but it has faced criticism due to long processing times and fraud concerns. Trump’s "Gold Card" visa aims to differentiate itself with:

Higher Investment Threshold: At $5 million, it targets ultra-high-net-worth individuals. Faster Processing: The program promises significantly reduced wait times. Sector-Specific Investments: Unlike the EB-5’s job creation requirement, the focus is on direct economic contributions.Economic and Market Implications

The introduction of this visa could inject billions into the U.S. economy. Experts predict:

Increased foreign direct investment in U.S. real estate, boosting property values. Growth in infrastructure and business development through large capital inflows. Strengthening of the U.S. dollar due to demand from international investors.Political and Public Reactions

The plan has received mixed reactions. Proponents argue that it will:

Encourage foreign investment in the U.S. economy. Create jobs indirectly through business expansion. Reduce dependence on government-funded economic stimulus programs.Critics, however, raise concerns:

Favoring the Wealthy: Some argue that prioritizing high-net-worth individuals over skilled immigrants creates an unequal system. Lack of Job Creation Requirement: Unlike the EB-5, this program does not mandate direct employment opportunities for Americans. National Security Risks: There are concerns about potential misuse by foreign oligarchs and politically exposed individuals.Potential Legislative and Legal Challenges

For the "Gold Card" visa to take effect, it must pass through Congress, where immigration policies remain a contentious topic. Key challenges include:

Gaining bipartisan support in a politically divided climate. Addressing concerns about fairness in U.S. immigration laws. Establishing clear guidelines to prevent fraud and exploitationLatest In Media & marketing

Banking Magazine

Investing Amid Volatility in Trump’s Second Term

Investment

Investment Strategies in the USA: Adapting to Policy Shifts

Finance

Stock Market Trends: The Impact of U.S. Investment Regulations

Money