Trump's Tariffs Unleash Investor Uncertainty: Next Steps

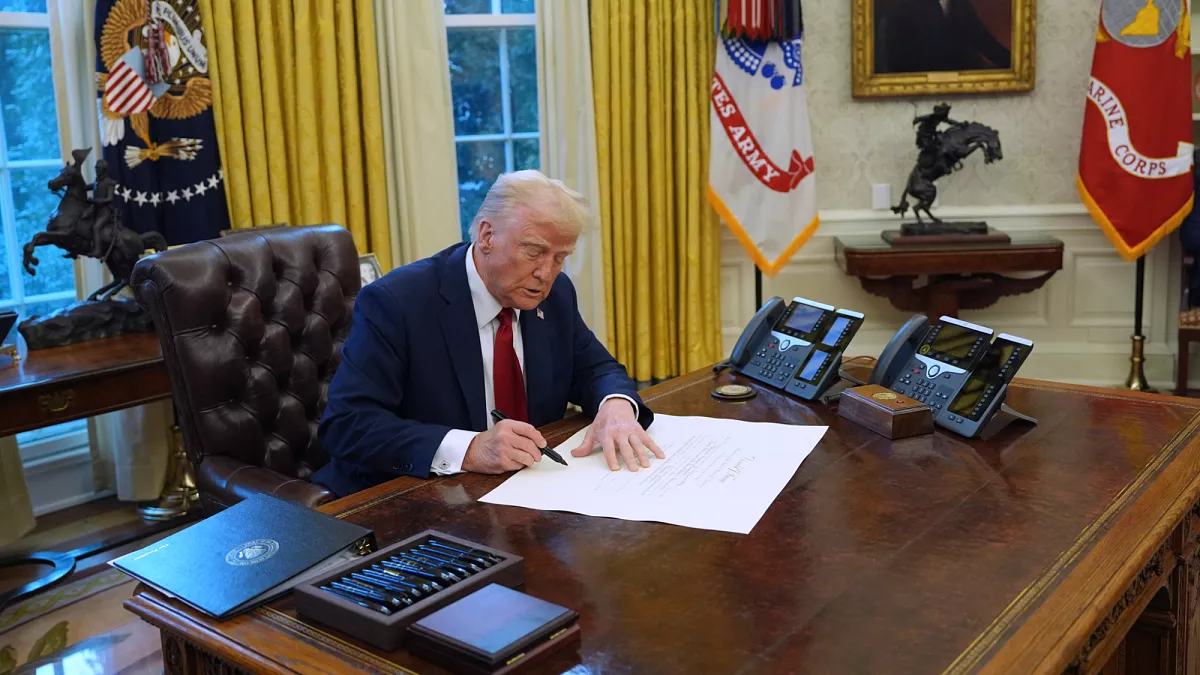

Former President Donald Trump's latest round of tariffs has sent shockwaves through global markets, leaving investors grappling with increased uncertainty. With businesses facing higher costs and trade tensions escalating, analysts weigh in on the long-term implications for industries, financial markets, and economic stability

President Donald Trump's trade policies have long been a topic of heated debate. With the introduction of new tariffs targeting various industries, the financial world is experiencing unprecedented volatility. This article explores the broader economic consequences, how markets are reacting, and the potential long-term impacts.

Understanding the Tariffs: What’s New?

Trump’s latest tariffs aim to pressure foreign competitors, particularly China, to level the playing field for American manufacturers. These include:

Increased tariffs on steel and aluminum imports

Higher duties on Chinese electronics and machinery

New levies on European automotive imports

Targeted tariffs on agricultural products

The administration claims these measures are designed to protect American jobs, but economists warn of unintended consequences.

Market Volatility and Investor Reactions

Stock Market Turmoil

Markets have responded with sharp fluctuations. The S&P 500, Dow Jones, and NASDAQ have seen increased volatility as investors adjust their portfolios to hedge against potential losses.

Bond Market and Safe-Haven Assets

With uncertainty rising, many investors are shifting capital into bonds, gold, and other safe-haven assets. The 10-year Treasury yield has dropped, reflecting investor concern over long-term economic growth.

Impact on Key Sectors

Manufacturing and Trade

While some domestic manufacturers may benefit, those reliant on imported raw materials are facing rising costs. Companies like Boeing and GM have expressed concerns about supply chain disruptions.

Technology and Consumer Goods

The increased tariffs on Chinese imports have placed tech companies in a difficult position. Rising costs for semiconductors and hardware are expected to lead to higher consumer prices.

Agriculture and Food Industry

Farmers have been hit hard, with China and other trade partners retaliating by imposing tariffs on American agricultural products. Soybean, pork, and dairy farmers face declining exports and revenue losses.

Global Trade Relations and Diplomatic Strain

Trump’s tariffs have strained relations with key trading partners, leading to:

Retaliatory tariffs from China, the EU, and Canada

Disruptions in US-Mexico-Canada Agreement (USMCA) trade flows

Diplomatic negotiations with the WTO over tariff disputes

The Future of US Trade Policy

Economic experts are divided on whether these tariffs will lead to renegotiated trade deals or prolonged economic instability. Some argue that they provide leverage for the US in negotiations, while others warn of potential recessionary effects.

Final Thoughts: What’s Next for Investors?

As trade tensions escalate, investors must remain cautious. Diversifying portfolios, monitoring emerging markets, and staying informed on policy changes will be crucial in navigating this volatile economic landscape.

Latest In Media & marketing

Banking Magazine

Investing Amid Volatility in Trump’s Second Term

Investment

Investment Strategies in the USA: Adapting to Policy Shifts

Finance

Stock Market Trends: The Impact of U.S. Investment Regulations

Money