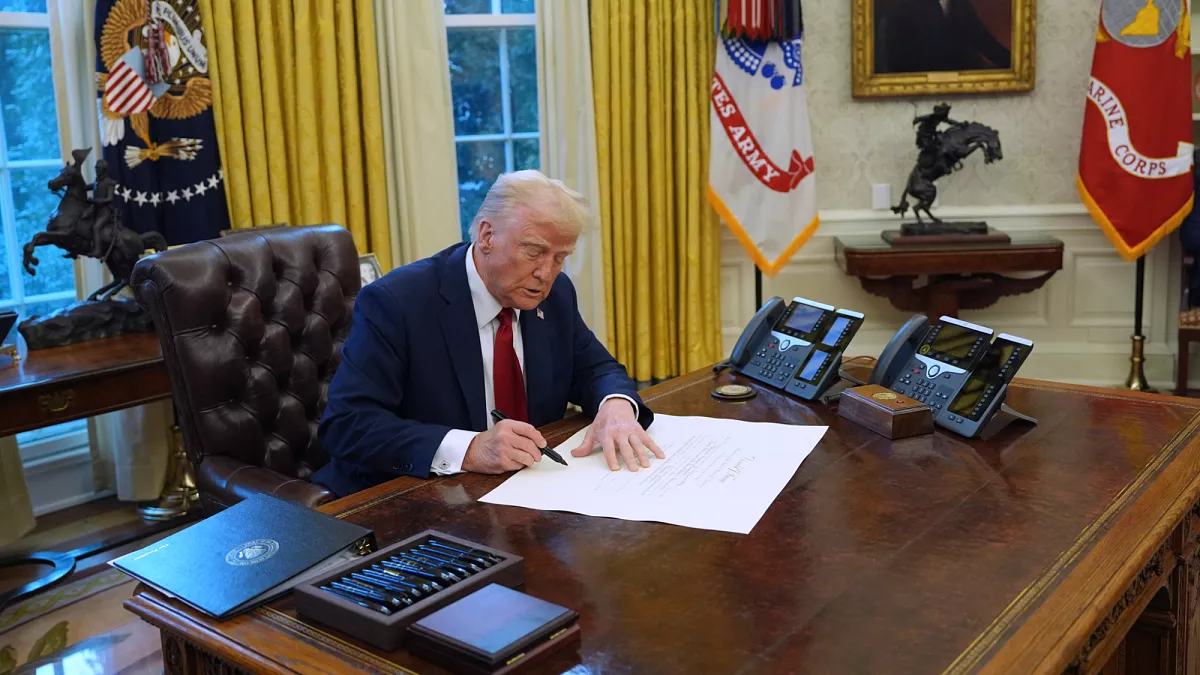

Trump Administration Previews New Investment Restrictions

The Trump administration has introduced new investment restrictions to protect U.S. businesses and national security. The policy focuses on limiting foreign investments in key industries, especially from adversarial nations like China and Russia, while encouraging domestic economic growth

In a move to strengthen national security and economic independence, the Trump administration has announced a set of new investment restrictions, aimed at limiting foreign control over critical American industries. These restrictions are primarily focused on technology, manufacturing, infrastructure, and national defense sectors.

The new policy will expand the role of the Committee on Foreign Investment in the United States (CFIUS), ensuring stricter oversight on foreign acquisitions. It specifically targets nations that pose economic or security risks, including China, Russia, and other strategic competitors.

Key Aspects of the New Investment Restrictions

Strengthening National Security

CFIUS will intensify scrutiny of foreign investments in AI, cybersecurity, semiconductors, telecommunications, and defense. Real estate purchases near military bases and key infrastructure sites by foreign investors will face new restrictions.Protecting U.S. Jobs & Economy

Limits on foreign takeovers of American companies to prevent offshoring and job losses. Incentives for U.S. firms to reinvest domestically rather than seeking foreign capital.Targeting Investments from Adversarial Countries

Restrictions on Chinese and Russian firms acquiring stakes in U.S. technology, energy, and defense companies. Increased monitoring of foreign funding in critical industries.Encouraging Allied Investments

While adversarial nations face restrictions, allied countries like Canada, the UK, Japan, and Australia may continue investing with fewer regulatory hurdles.Impact on Foreign Direct Investment (FDI)

Decline in Foreign Investments

The new restrictions are expected to reduce overall foreign direct investment (FDI) in the U.S., especially in high-tech industries.

Shift in Global Trade Relations

The policy could lead to increased tensions between the U.S. and nations affected by the restrictions, potentially triggering retaliatory investment bans or trade disputes.

Reactions from Business and Political Leaders

Supporters argue the policy is necessary to protect national security, U.S. jobs, and critical industries. Critics warn it may discourage foreign capital, slow economic growth, and lead to retaliatory measures from other nations.International Reactions

China’s Response

China’s Ministry of Commerce has strongly opposed the restrictions, calling them "discriminatory and protectionist." Officials warned of economic consequences and potential trade countermeasures against U.S. firms operating in China.

Russia’s Criticism

Russian economic officials criticized the policy, arguing that the U.S. is weaponizing investment laws to control global trade and limit economic competition.

Latest In Media & marketing

Banking Magazine

Investing Amid Volatility in Trump’s Second Term

Investment

Investment Strategies in the USA: Adapting to Policy Shifts

Finance

Stock Market Trends: The Impact of U.S. Investment Regulations

Money