Systematic Equity Outlook: Cutting Through Market Uncertainty

The stock market remains uncertain amid economic shifts. Systematic equity strategies provide a data-driven approach to managing risk and optimizing returns

The stock market has always been subject to fluctuations, but recent economic instability, inflation concerns, and geopolitical risks have created an environment of heightened uncertainty. For investors, navigating these conditions requires a structured approach—this is where systematic equity investing comes into play.

Systematic equity strategies use quantitative models, data analytics, and algorithmic trading to remove emotional bias and enhance decision-making. By relying on historical data and predictive modeling, these strategies help investors identify market trends, minimize risks, and capitalize on emerging opportunities.

Key Market Factors Driving Uncertainty

Interest Rate Adjustments – Central banks continue adjusting interest rates to manage inflation, directly impacting stock valuations and investment flows. Geopolitical Tensions – Global conflicts, trade restrictions, and supply chain disruptions contribute to unpredictable market movements. Corporate Earnings Volatility – Businesses face challenges in forecasting revenues due to shifting consumer behavior and inflationary pressures. Technological Disruptions – Rapid advancements in artificial intelligence, fintech, and biotech are reshaping industries and influencing stock performance.How Systematic Equity Investing Provides Stability

Systematic equity investing is designed to reduce risk and improve consistency in portfolio performance. Key benefits include:

Data-Driven Decision-Making: Algorithms analyze market conditions in real-time, allowing for objective investment choices. Factor-Based Investing: Identifies profitable stocks based on momentum, value, growth, and volatility metrics. Risk Management Techniques: Uses hedging, diversification, and stop-loss strategies to protect against market downturns. Automation and Efficiency: Algorithmic trading minimizes human error and optimizes execution timing.Sectors That Benefit Most from Systematic Equity Strategies

Technology: The rapid adoption of AI, cloud computing, and digital services presents long-term investment opportunities. Healthcare & Biotech: Innovations in pharmaceuticals, medical technology, and personalized healthcare are driving industry growth. Renewable Energy: Global initiatives to reduce carbon emissions are fueling investments in clean energy and sustainable infrastructure. Consumer Staples: Defensive stocks in food, healthcare, and essential goods provide stability in economic downturns.Investment Strategies for Systematic Equity Investors

Portfolio Diversification – Spreading investments across multiple asset classes to mitigate risk. Quantitative Stock Screening – Using machine learning models to identify undervalued or high-growth stocks. Thematic Investing – Focusing on long-term trends such as digital transformation, AI, and sustainability. Dynamic Asset Allocation – Adjusting stock exposure based on evolving market conditions.Conclusion: A Data-Driven Future for Equity Investing

In an era of market volatility, systematic equity investing offers a structured, research-backed approach to wealth creation. By leveraging advanced analytics, risk management strategies, and automated decision-making, investors can cut through uncertainty and optimize returns.

While short-term market fluctuations are inevitable, systematic strategies provide a long-term framework for stability and growth, making them a valuable tool in modern investing

Latest In Media & marketing

Banking Magazine

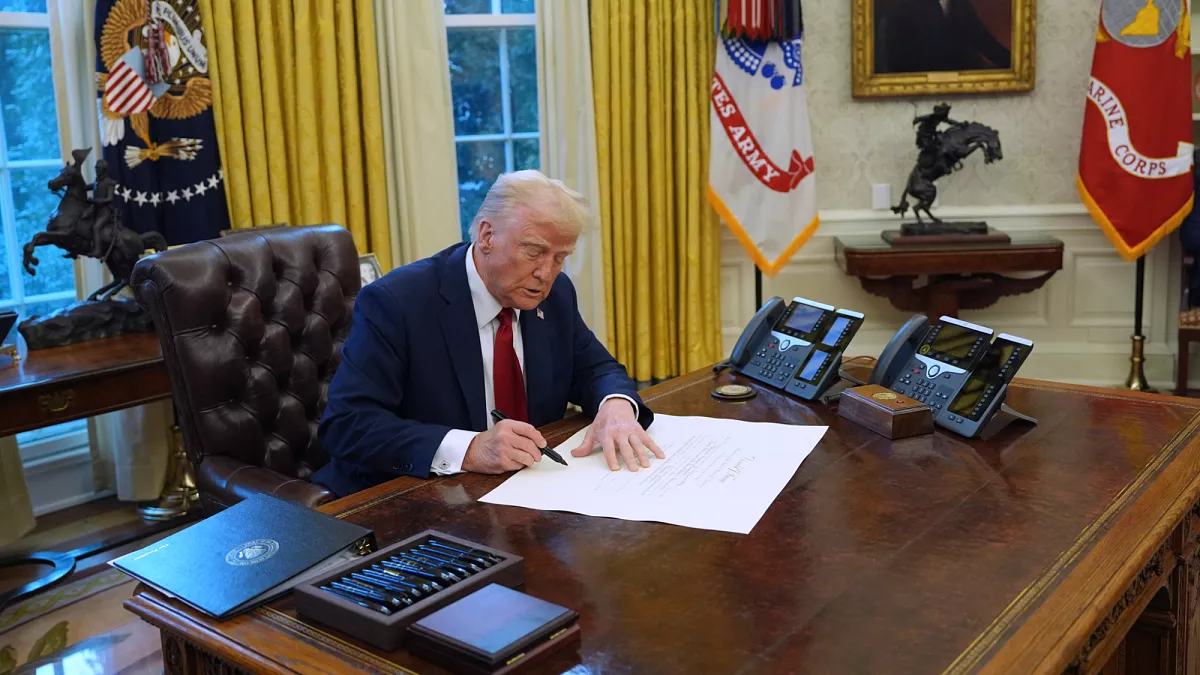

Investing Amid Volatility in Trump’s Second Term

Investment

Investment Strategies in the USA: Adapting to Policy Shifts

Finance

Stock Market Trends: The Impact of U.S. Investment Regulations

Money