U.S. Investment Policies & iShares SLQD Bond ETF Outlook

The iShares 0-5 Year Investment Grade Corporate Bond ETF (SLQD) is a low-risk option for investors. Learn how U.S. investment policies influence its performance

The iShares 0-5 Year Investment Grade Corporate Bond ETF (SLQD) is a popular choice among investors looking for short-term, investment-grade corporate bond exposure. Given its focus on lower-duration securities, SLQD provides stability and income generation while minimizing interest rate risk.

However, the performance of SLQD is directly influenced by U.S. investment policies, particularly those related to interest rates, fiscal policy, bond market regulations, and credit standards. Understanding these policies is essential for investors seeking to optimize their fixed-income portfolios.

Key Features of iShares SLQD

Short-Term Investment-Grade Bonds

Tracks the Bloomberg U.S. Corporate 0-5 Year Index. Holds bonds from top-rated companies with maturities under five years.Lower Interest Rate Sensitivity

Less vulnerable to rising interest rates compared to long-duration bonds. Provides a hedge against market volatility in uncertain economic conditions.Diversified Corporate Debt Holdings

Includes bonds from major companies such as Apple, Microsoft, JPMorgan Chase, and Amazon. Offers broad sector exposure with reduced credit risk.Impact of U.S. Investment Policies on SLQD

1. Federal Reserve’s Monetary Policy

The Federal Reserve (Fed) plays a significant role in shaping the corporate bond market.

When Interest Rates Rise → Short-term bonds like SLQD become more attractive due to their lower duration. When Interest Rates Fall → Investors may shift to higher-yielding, long-term bonds, impacting SLQD demand.The Fed’s 2024 policy outlook indicates a cautious approach, balancing inflation control with economic growth. This affects corporate bond yields, ETF performance, and investor sentiment.

2. Inflation and Economic Growth

Inflation impacts bond yields and investor behavior. If inflation remains high:

Corporate borrowing costs increase, influencing bond issuance and yields. Investors prefer short-term bonds like SLQD over long-duration options.Conversely, if inflation stabilizes, corporate bond ETFs like SLQD maintain steady returns with lower risk.

3. Fiscal and Regulatory Policies

The U.S. government’s bond market regulations and corporate tax policies directly impact SLQD. Key policy influences include:

Corporate Bond Market Regulations – Stricter lending standards can reduce corporate bond supply. Tax Incentives for Fixed-Income Investors – Favorable tax treatments can make corporate bond ETFs more appealingLatest In Media & marketing

Banking Magazine

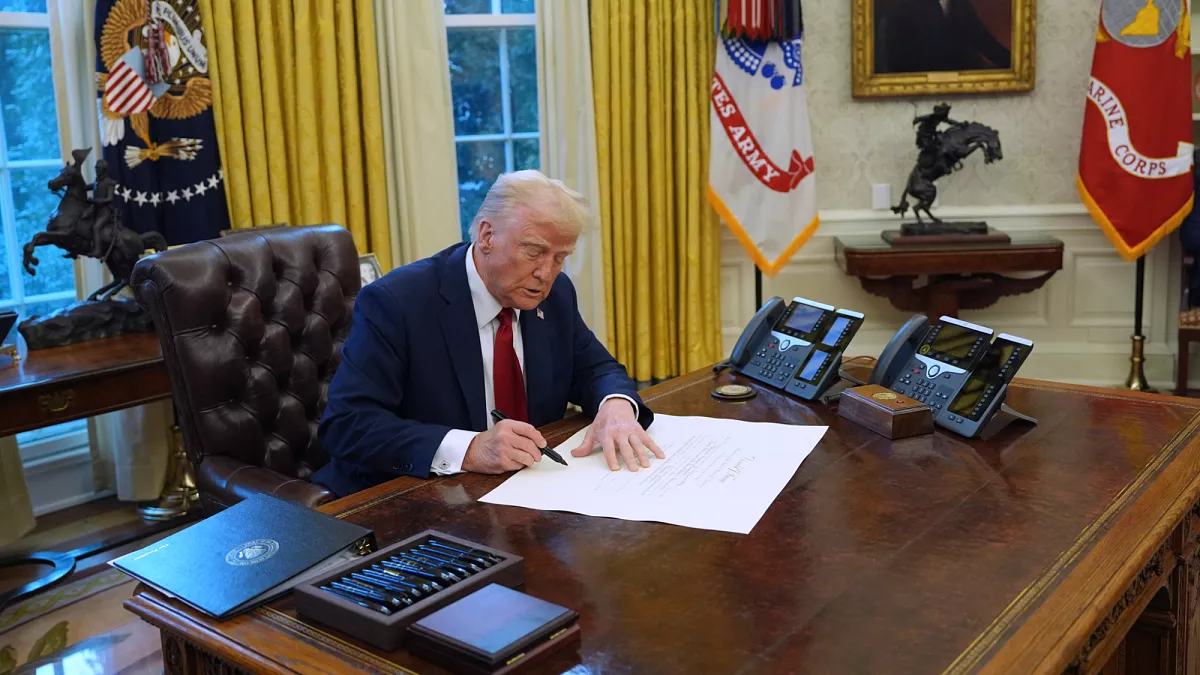

Investing Amid Volatility in Trump’s Second Term

Investment

Investment Strategies in the USA: Adapting to Policy Shifts

Finance

Stock Market Trends: The Impact of U.S. Investment Regulations

Money