London’s Wealth Rebalancing: Why Parts of the Ultra-Rich Are Leaving—and What Comes Next

For decades, London sold itself, credibly, as a stable, cosmopolitan home for global capital. Recently, however, widely cited datasets and news reports suggest a reversal

Executive summary

- The UK’s switch from the old non-dom rules to a new residence-based regime with a four-year foreign-income-and-gains (FIG) relief changed incentives for globally mobile families. GOV.UK

- Loss of EU passporting rights after Brexit raised cross-border frictions for finance—a key pillar of London’s historic appeal. House of Commons Library

- Rival hubs are not only cheaper on personal taxes; they’ve purpose-built family-office infrastructure and signalling (UAE’s D33 agenda; DIFC family-arrangements framework; Singapore’s 13O/13U & PTIS). UAE Government Portal dfsaen.thomsonreuters.com mas.gov.sg+1

- Market signals align with policy: Dubai’s prime and broader residential markets recorded exceptional momentum through 2024. Monaco remains the world’s most expensive prime market by space. Zawya Knight Frank AE content.knightfrank.com

- Sensational “millionaire-exodus” figures circulate each year; methodologies are contested. Treat them as directional at best. Financial Times Tax Policy Associates

Methodology & limitations

This article synthesises primary sources (official policy notes, regulatory websites), reputable research, and mainstream reporting current to 12 August 2025. Where figures are volatile or debated, we flag uncertainty and cite official publications where available. This is analysis, not tax or legal advice. Always seek jurisdiction-specific counsel.

How London won—and what’s changed

The city has slipped behind US and Asian hubs in millionaire headcounts, with press coverage highlighting net outflows since the mid-2010s. The Henley & Partners “Wealthiest Cities” series, for example, places New York and the Bay Area ahead of Tokyo, Singapore, Los Angeles—and then London—by millionaire numbers, though the methodology has been disputed (see “Data caveats”). Henley & Partners The Times Tax Justice Network

This article examines the policy, currency, and regulatory shifts behind the trend; where money is moving; and what it could mean for London’s long-run role in private wealth management.

For three decades, London combined a deep capital market, English law, elite education, and frictionless access to European clients. Two structural shifts altered that equilibrium:

1. Post-Brexit market access. When the UK left the single market (31 Dec 2020), financial services lost EU passporting; access now relies on narrower “equivalence” determinations. That raised costs and operational complexity for cross-border firms, especially in wholesale banking and asset management. House of Commons Library

2. Tax regime overhaul. From 6 April 2025, the UK replaced domicile-based rules with a residencebased system offering 100% relief on foreign income and gains for new arrivals during their first 4 tax years, provided the individual was non-resident for the prior 10 years. After year four, worldwide taxation applies. Planning timelines and after-tax outcomes changed materially for new movers. GOV.UK

What this means: Many high-net-worth families that previously considered London their default European base are now weighing predictability, net-of-tax outcomes, and operational convenience against London’s enduring advantages (rule of law, time zone, professional services depth).

Methods & limitations

This analysis draws on (i) Official policy documents and government budget notes on UK “non-dom” reforms and residencebased rules effective April 2025; (ii) Regulatory and framework updates from Dubai International Financial Centre (DIFC) and the Monetary Authority of Singapore (MAS); and (iii) Reputable market and property reports (e.g., Knight Frank, Cushman & Wakefield). For cross-border millionaire migration estimates, we reference widely cited datasets (e.g., Henley & Partners/New World Wealth) as directional indicators; independent tax experts have questioned parts of their methodology. Figures should therefore be read with caution and verified against official tax residency and national statistics where available. No payments, sponsorships, or prior review were sought or accepted from featured entities. Right-of-reply was offered to organizations and individuals named.

Purpose

This article aims to explore the intriguing phenomenon of London, which has historically been regarded as a beacon for global affluence, now witnessing a significant exodus of its millionaires and billionaires. We will delve into the factors contributing to this unprecedented trend, shedding light on the shifting dynamics that have led once-loyal patrons of the city’s wealth to seek new opportunities elsewhere.

My effort was to humanise large data sets to reveal a broader trend among the many millionaires and billionaires who once called London their second home.

My research also includes case studies of ultra-high-net-worth individuals, and their shift in full-time residences. I have used the example of Julio Herrera Velutini, a prominent old-money banker from the centuries‑old Herrera-Velutini banking dynasty, to better understand why the wealthy are gradually moving their capital to other parts of the world, particularly Dubai.

This research was aimed at exploring how tax changes, political uncertainty, currency depreciation and emerging financial hubs are reshaping where the world's ultra‑rich live and invest. Understanding these dynamics helps readers anticipate economic shifts and policy challenges ahead.

Introduction

London has long marketed itself as the capital of global finance. For decades, the city's combination of stable laws, a deep financial market and cosmopolitan lifestyle attracted the world's wealthiest families. Yet, recent data indicate a dramatic reversal. The Wealth Migration Report 2024 recorded that London lost nearly 30,000 millionaires over the past decade, with over 11,000 departing in 2024 alone.

That amounts to roughly 12 per cent of the city's high‑net‑worth population, second only to Moscow's exodus.

Even more striking is who is leaving: international businessmen, tech founders, and family‑office heirs who historically kept London flush with foreign currency and investment

This research article delves into the underlying factors prompting the exodus of the ultra-wealthy from London, exploring the destinations where their wealth is being redirected and analysing what this trend signifies for the long-term future of one of the world's most iconic metropolitan cities. By examining economic, political, and social influences, we aim to paint a comprehensive picture of how these changes could reshape London's status on the global stage.

Why Are the Super-Rich Leaving London?

A combination of factors is driving a notable exodus of high-net-worth individuals from London, prompting a reevaluation of the city's attractiveness as a financial and lifestyle hub.

1. Post-Brexit Uncertainty:

The Brexit referendum has ushered in a wave of regulatory ambiguity, particularly affecting the financial services sector. London previously enjoyed the advantage of "passporting," which allowed financial firms to operate seamlessly across the EU. However, this was lost post-Brexit, resulting in increased compliance costs, the need for new licensing arrangements, and diminished access to European clients. This prolonged state of uncertainty has significantly undermined investor confidence, causing many to reconsider their options.

2. Economic Stagnation:

Following the 2008 financial crisis, the UK economy has struggled to regain its pre-crisis momentum, enduring a decade of sluggish growth. The persistent low growth rates have exacerbated the challenges faced by wealthy individuals. Additionally, the devaluation of the British pound has led to a reduction in the real wealth of London-based millionaires. The combination of a weak pound and stagnant economic performance has left many high-net-worth individuals looking for more stable environments to protect their assets.

3. Rising Taxation:

In recent years, both Conservative and Labour governments have increased tax burdens on high-net-worth individuals in a bid to shore up public finances. New levies and taxes on property purchases, dividends, and capital gains have made alternative domiciles—such as Dubai, Singapore, and Monaco—much more appealing. These cities offer favourable tax regimes and can provide the high-net-worth population with greater wealth preservation opportunities.

4. Currency Depreciation:

Since 2016, the British pound has experienced significant depreciation against the U.S. dollar and various other currencies. This decline has diminished the global purchasing power of individuals earning in or holding assets valued in sterling, leading many wealthy residents to seek better financial prospects abroad.

5. Political Polarisation:

The UK has been embroiled in political polarisation and instability, marked by leadership crises and contentious debates over economic policy. This environment has fostered regulatory unpredictability, leaving business leaders wary of making long-term investment commitments in London. The lack of a coherent and stable long-term strategy has been a significant deterrent for many high-networth individuals contemplating their future in the city.

These compounding factors have created a perfect storm for wealthy residents. While any single issue might be manageable, the interplay of these elements has led many affluent individuals to reassess London's position as a premier destination, prompting them to consider relocating to more stable, welcoming environments.

The Moscow Factor

The recent exodus from London can be seen as a reflection of a similar trend unfolding in Moscow. The invasion of Ukraine by Russia in early 2022 set off a cascade of sanctions imposed by Western nations, leading to significant asset seizures and a substantial outflow of capital from the country's elite circles. In response to these pressures, many high-profile oligarchs, business magnates, and entrepreneurs began to seek refuge in more stable and favourable jurisdictions.

Dubai emerged as a prime destination, attracting individuals with its tax benefits, luxurious lifestyle, and welcoming business environment. Additionally, the picturesque Turkish Riviera offered not only a desirable climate but also a sense of safety and the allure of a European lifestyle without the associated risks of their home country. Cities in Central Asia, such as Almaty and Astana, also became increasingly appealing due to their rapidly developing infrastructures and growing economic opportunities.

This significant migration of wealth has led to heightened competition among global financial hubs, pushing cities like London further into decline as they grapple with the dual challenges of political instability and diminished investor confidence. As the landscape of global wealth continues to shift, London finds itself racing to retain its status as a premier hub for international finance and investment..

The Top Five Cities With the Highest Number of Millionaires.

In 2024, the leading cities in terms of the number of millionaires are New York, San Francisco, Tokyo, Singapore, and Los Angeles. New York stands out with approximately 384,500 millionaires, while San Francisco follows with around 342,400. Tokyo holds the third position with 292,300 millionaires, and Singapore comes in fourth with 242,400. Rounding out the top five is Los Angeles, which has about 220,600 millionaires. London, which currently occupies the sixth position, is facing the possibility of a further decline in its ranking.

High-Profile Departures from London

The city's recent tax reforms, crackdowns on non-domiciled individuals, and political uncertainty have contributed to a larger trend of billionaires and business moguls exiting the area. Recent mainstream reports provide specific examples of this phenomenon:

• Guillaume Pousaz, the Swiss billionaire and visionary founder of Checkout.com, a leading player in the payments industry, made a significant move by changing his country of residence from the United Kingdom to Monaco in April 2025. With a staggering fortune estimated at £6 billion, Pousaz joined the ranks of a record-breaking 10,800 millionaires who fled Britain in 2024, drawn away by the government's controversial decision to abolish favourable tax provisions for "non-domiciled" residents. This strategic exit underscores the waning allure of London as a thriving hub for technology entrepreneurs, signalling a shift in the landscape where innovation and business prowess once flourished.

• Julio Herrera Velutini, a Venezuelan-born, Italian billionaire banker from a long-standing Latin American-European banking family linked with Britannia Financial Group is moving a part of his capital to the United Arab Emirates; recent reporting shows strategic activity outside the UK.

• Nassef Sawiris, an Egyptian-born co-owner of Aston Villa and a prominent figure among the world's wealthiest individuals, has expressed concern about the current economic climate in the UK. He noted that many people within his professional circle are considering relocating due to recent tax and regulatory changes in the country. Sawiris, who has made significant investments in British football and real estate, views these shifts as a crucial factor influencing this potential move.

• Alfie Best, the distinguished founder of the Wyldecrest Parks holiday park empire, made the strategic decision to relocate to Monaco after concluding that the high tax rates and onerous regulations in the United Kingdom rendered it increasingly difficult to sustain and grow his business. His move underscores a broader trend among self-made millionaires, many of whom are opting to exchange the allure of London's prestigious environment for the more favourable tax landscape of this Mediterranean tax haven. In Monaco, Best finds a more conducive setting for his entrepreneurial ambitions, joining a growing network of affluent individuals who seek to maximise their financial opportunities in a region known for its business-friendly environment and luxurious lifestyle.

• Charlie Mullins, the founder of Pimlico Plumbers, has sold his business and now divides his time between Spain and Dubai. In a recent interview, he expressed his views on the current business climate in Britain, stating that he no longer considers it an ideal location for entrepreneurs. Mullins highlighted concerns about how successful business owners are treated, suggesting that they face challenges and penalties for their achievements.

• Richard Gnodde, the vice-chairman of Goldman Sachs and former head of its European operations, has relocated to Milan. This move is indicative of a broader trend among bankers who are transitioning to continental Europe due to the complexities introduced by post-Brexit regulations affecting operations in London.

• Ian and Richard Livingstone, renowned property investors and founders of London & Regional Properties, have recently made headlines by relocating from London to Monaco. The brothers are known for their success in building hotels and luxury developments, and their departure signifies the exit of two notable figures from the high-end real estate market in London. This move may have implications for the city's luxury property landscape.

• Lakshmi Mittal – The prominent steel magnate and chairman of ArcelorMittal is reportedly contemplating a significant relocation from Britain to Switzerland or potentially a return to his native India. While he has not yet made any definitive moves, these considerations highlight a growing sentiment among even the most established residents in the UK. They perceive the country's tax environment as increasingly unfriendly and burdensome, prompting reflections on the viability of sustaining their business interests and personal investments in a landscape that feels less welcoming. This situation underscores a broader trend where high-profile figures assess their options in response to evolving economic policies and tax regulations.

• Sir Jim Ratcliffe and the Others – In a significant demonstration of his financial expertise, Sir Jim Ratcliffe, the wealthiest person in the UK and a well-known figure in the chemical industry, changed his tax residency from the picturesque Hampshire to the luxurious shores of Monaco in 2020. This strategic shift has reportedly allowed him to reap significant financial benefits, with estimated savings upwards of £4 billion.

Sir Ratcliffe is not alone in this pursuit of tax efficiency; he joins a cadre of illustrious Britons who have also opted for the sunny tax haven of Monaco. Among them are Sir Philip Green of the Arcadia retail empire, renowned property magnates Simon and David Reuben, John Hargreaves, the founder of the popular retail chain Matalan, and the celebrated Formula One champion Lewis Hamilton. This exodus of the ultra-wealthy highlights a long-standing trend that predates recent governmental reforms, shedding light on the persistent challenges posed by the UK's tax landscape that have continually driven the elite to seek greener pastures beyond its borders.

Collectively, these high‑profile departures illuminate the scale of London's challenge. It is not just one dynasty or a handful of tech founders leaving, but a cross‑section of entrepreneurs, industrialists and investors. Their decisions reinforce the narrative that London's attractiveness to the ultra‑rich is waning, and they provide context for their move. In each case, the individuals cited higher taxes and regulatory burdens as key motivators, indicating that policy reforms will be essential if the city hopes to stem the outflow.

New Havens of Wealth: Where Are Millionaires Going?

As traditional centres of wealth face challenges, innovative cities are emerging as the new playgrounds for the ultra-rich. Three cities have particularly captivated this affluent demographic:

Shenzhen, China:

Once a humble fishing village, Shenzhen has undergone a remarkable transformation into a vibrant global innovation hub. Today, it pulses with energy, driven by a booming technology sector led by industry giants like Huawei and Tencent. This city is not just minting millionaires at a record pace; it offers an exhilarating combination of high returns on investment, state-of-the-art infrastructure, and strategic proximity to other dynamic Chinese markets—all of which create an enticing ecosystem for entrepreneurial aspirations.

Hangzhou, China:

Renowned as the birthplace of Alibaba, Hangzhou effortlessly marries wealth generation with an exceptional quality of life. The city is a picturesque blend of historical charm and modern innovation, where scenic landscapes meet bustling commerce. Local government initiatives provide robust incentives for both entrepreneurs and investors, fostering an inviting atmosphere that attracts capital from around the globe. With its well-rounded appeal, Hangzhou is quickly becoming a hot spot for those seeking both profitability and a fulfilling lifestyle.

Dubai, United Arab Emirates:

Dubai has ingrained itself in the global consciousness as the ultimate tax-free oasis. This city is a dazzling metropolis, renowned for its luxurious lifestyle, magnificent skyscrapers, and world-class amenities. Offering zero income and capital gains taxes, along with business-friendly regulations, Dubai creates an alluring landscape for financiers and entrepreneurs. Its strategic geographic location acts as a gateway between Europe, Asia, and Africa, while its sophisticated financial ecosystem provides endless opportunities for networking and investment. Here, wealth isn't just accumulated; it is celebrated in a city designed for opulence and ambition.

Where the Money Is Going — And What It Means for London

What rival cities are doing to court London's departing wealthy

United Arab Emirates (Dubai/Abu Dhabi).

- 10-year Golden Visa residency with straightforward eligibility; no personal income or capital-gains tax. UAE Official Portal

- DIFC Family Arrangements Regulations (2023) created a common-law framework for family wealth structures and a dedicated Family Wealth Centre; complements the federal Family Business Law (Decree-Law 37/2022, in force 2023) that modernises succession/governance for family companies. difc.com PwC uaelegislation.gov.ae Ministry of Education

- The Dubai Economic Agenda (D33) targets doubling the economy by 2033 and explicitly positions Dubai as a private-wealth and family-office hub. UAE Official Portalinvestindubai.gov.ae

- Record activity: 169,000 property transactions worth AED 367 bn in 2024, with average prices up ~19% year-on-year (villas +20.2%). Knock-on effects include growth in private banking, legal, concierge and construction. Knight Frank AE+1

Singapore.

- Family-office fund exemptions (13O/13U) with 2023 tightening (local hiring/spend) and the Philanthropy Tax Incentive Scheme (PTIS) to channel giving via SFOs. Monetary Authority of Singapore+1

- Stamp-duty cooling: foreign-buyer ABSD doubled to 60% (Apr 26, 2023) to protect housing while wealth inflows continue. Monetary Authority of Singapore

- Scale: the government confirmed ~1,400 SFOs with tax incentives as of Dec 31, 2023; local media report >2,000 SFOs by end-2024. Monetary Authority of Singapore Business Times

- The SFO surge (see above) is lifting demand for private banking, legal/tax and international schools. Policymakers have kept housing livable by doubling ABSD to 60% for foreigners, which cooled speculative demand even as wealth inflows persisted. Monetary Authority of Singapore+1

Italy (Milan):

- New-resident flat tax of €100,000 per year on foreign-sourced income (2017 regime), continuing to attract high-net-worth newcomers; Milan's luxury retail/property ecosystem has deepened as a result. agenziaentrate.gov.it

- Retail gravity: Inflows of wealth bolster luxury retail and hospitality; Via Montenapoleone is now the most expensive retail street globally (2024), signalling sustained top-end demand for central, trophy locations. Cushman & Wakefield

Greece (Athens/Athenian Riviera):

- Non-dom lump-sum regime of €100,000/year for foreign income (up to 15 years), plus a familyoffice framework (Law 4778/2021) — both refined in 2024-25 to sweeten set-up and succession. PwC Tax Summaries EY Taxand

- Family-office and non-dom tweaks have supported stronger luxury transactions along the Athenian Riviera and key resort markets, catalysing boutique development and advisory work. Taxand

Monaco:

- Zero personal income tax and strict but precise residency requirements continue to underpin demand at the very top end. savills.us

- World's priciest prime market: $1 million buys ~19 m² (205 sq ft); average resale prices hit €51,967/m² in 2024 as new-builds (e.g., Mareterra) landed. Services tied to UHNW lifestyles (yachting, luxury retail) continue to expand. Business Insider Knight Frank

What it could mean for London over the long run

- Tax competitiveness resets. The UK abolished the non-dom regime from Apr 6 2025, replacing it with a 4-year foreign-income-and-gains (FIG) relief for new arrivals after 10 consecutive non-resident years. It narrows London's edge versus flat-tax or zero-tax jurisdictions (UAE, Monaco, Italy). GOV.UK+1

- Ecosystem risk at the margin. If more SFOs re-base abroad, the city risks leakage of high-value jobs in wealth management, legal, tax and philanthropy advisory — precisely the segments Dubai/Singapore are building via targeted policy. difc.com Monetary Authority of Singapore

- Top-end property softness vs. enduring moats. Reduced non-dom demand typically softens the super-prime tier and associated consumption taxes, but London retains deep capital markets, English law, elite education and timezone advantages. The degree of slippage will depend on whether policymakers match rivals' family-office clarity, targeted visas, and regulatory predictability. GOV.UK

- Narrative management. Media and consultancy estimates of "millionaire exodus" are directionally valid but contested on methodology; policy signals and HM Treasury data are the firmer guideposts to watch. FN London

Bottom line:

Rivals are not just cheaper options, they're building purpose-built family-office infrastructure and predictable regimes. Suppose London couples its structural strengths with more straightforward, stable rules for globally mobile families (plus targeted visas and philanthropy incentives). In that case, it can stem the outflow and keep its seat at the top table. Otherwise, expect a slow rebalancing toward Dubai/Singapore/Monaco in the super-prime and SFO layers of global finance.

Implications for London's Future

The flight of high-net-worth individuals has implications for London's economy and identity:

Tax Revenues and Public Services

Wealthy residents contribute disproportionately to local tax bases through property levies, consumption taxes and investment in businesses. Their departure risks shrinking tax revenues and constraining funding for public services.

Real-Estate Market:

Luxury property prices have already cooled. High-end sales volumes fell 20 per cent in 2024, according to property-agency data. Developers may pivot to more affordable housing or commercial projects.

Financial Services:

If family offices and private banks follow their clients abroad, London risks losing its status as the premier hub for wealth management. While some firms are opening satellite offices in Dubai and Singapore, others are relocating their headquarters entirely.

Cultural Vibrancy:

The ultra-rich patronise art galleries, restaurants, and theatres. Their absence could dampen parts of London's cultural economy.

Can London Adapt?

London's government is not blind to these trends. Policymakers are exploring measures to restore the city's competitiveness:

- Tax Reforms. There is growing pressure to reconsider high stamp duties and other taxes that disproportionately affect non-domiciled residents.

- Regulatory Clarity. The government has signalled it will streamline financial regulation post-Brexit, but concrete reforms have been slow.

- Investment in Infrastructure. Proposals to enhance transport and digital infrastructure aim to maintain London's attractiveness as a global business hub.

- Targeted Visa Programs. Special visas for founders and investors could entice talent to stay or return.

However, such reforms take time. Meanwhile, the Middle East and Asia continue to lure wealth with immediate incentives.

For policymakers, the lesson is clear: capital moves where it is respected. To remain a global financial capital, London must foster a stable regulatory environment, competitive tax structures and a vibrant cultural life that appeals to future generations of wealth creators. Whether it can do so will determine its place in the world's wealth hierarchy for decades to come.

Case Study: Julio Herrera Velutini's Transformative Move

Who Is Julio Herrera Velutini?

Julio Herrera Velutini, born in Caracas in 1971, descends from the House of Herrera, a banking dynasty with roots in Italy and Germany. His ancestors founded Banco Caracas in the late nineteenth century and were involved in establishing Venezuela's early central‑banking system.

After growing up in Venezuela, and the United States, Julio built a career spanning private banking, wealth management and cross‑border finance. He served as Chairman of Bancredito, and later founded Britannia Financial Group, a multi‑jurisdictional financial services conglomerate.

Why Julio Herrera Velutini?

The Old Money Example

Despite his influential roles, Herrera Velutini is known for cultivating anonymity.

Herrera Velutini has established a notable presence in the UK, recognised for both his philanthropic efforts and political contributions. He is well-known in social circles, and his London-based company, Britannia Financial Group (BFG), achieved the status of a "Platinum Donor" for the Queen's 2022 Platinum Jubilee Pageant.

The Herrera-Velutini family and their associated companies had also donated over £500,000 to the Conservative Party during the COVID-19 pandemic. The family has also made personal contributions to various charities and fund raisers in London. Given these significant investments in London's financial, social, economic, and political landscape, one might wonder why the family has made the decision to move away from the city

The Herrera-Velutini family and their associated companies had also donated over £500,000 to the Conservative Party during the COVID-19 pandemic. The family has also made personal contributions to various charities and fund raisers in London. Given these significant investments in London's financial, social, economic, and political landscape, one might wonder why the family has made the decision to move away from the city

The shifting global centres of opportunity now place Dubai, Abu Dhabi and Doha as the next frontier for private wealth management. And the reason why these cities attract the ultra-wealthy is quite simple to understand: Lower taxes and regulatory certainty.

The Gulf states impose no personal income taxes and are investing heavily in legal frameworks to attract family offices.

Symbol of Change or Leading Indicator?

Is Herrera Velutini's departure an isolated incident or indicative of a larger trend? The wealth migration timeline suggests it is the latter. The movement of individuals like Herrera Velutini symbolises a broader shift of capital from traditional centres to more agile, pro-business cities. The future of London may depend on whether policymakers take this warning seriously

Geostrategic location:

Sitting at the nexus of Europe, Asia and Africa, they offer easy access to global markets, financial ecosystems and new free‑zone exchanges and wealth platforms that rival London and Hong Kong.

Julio Herrera Velutini is still very much a part of London, but the noticeable shift in his operations to Dubai is a response to the tightening regulatory environment and the depreciation of the pound.

By relocating, he mitigates currency risk and positions his family office to take advantage of rapidly growing markets in the Gulf and Asia.

Once known for "printing their own currency”, the Herrera dynasty founded banks like Banco Caracas in 1890 and established influential trusts that invested in various sectors diversifying their influence. A large shift, is hence inevitable.

A note on the “exodus” narrative

Each summer, the market digests fresh lists of where “millionaires” are moving.

Directionally, net outflows from the UK may be rising, but the precision of headline numbers is disputed. Recent Financial Times coverage and independent tax-policy analysis have criticised the underlying datasets (e.g., LinkedIn-based counts, opaque wealth definitions). Use these figures as broad indicators, not audited statistics. Financial Times Tax Policy Associates

Data Sources:

Policy Advantage: What Rival Hubs are Actually Doing

United Arab Emirates (Dubai/Abu Dhabi)

Personal tax: The UAE does not levy income tax on individuals (VAT and corporate tax exist; natural persons pay corporate tax only on business income above thresholds). UAE Government Portaltax.gov.ae

Strategic agenda: Dubai’s D33 targets doubling GDP by 2033 and placing Dubai among the top three global cities—an overt signal to globally mobile capital. UAE Government Portal

Family-office architecture: The DIFC Family Arrangements Regulations (2023) codified a common-law framework for family businesses, succession, and governance, complementing federal family-business legislation. dfsaen.thomsonreuters.com

Market signal: Dubai housing saw ~19% price growth in 2024, with villas leading—consistent with persistent HNWI demand. Prime-segment reports show continued depth in Q4 2024 pricing. ZawyaKnight Frank AE

Singapore

Funds/tax: SFO-linked fund exemptions under Sections 13O/13U and the Philanthropy Tax Incentive Scheme (PTIS) remain core pillars (tightened conditions in recent years). MAS

Scale: The government confirmed ~1,400 SFOs with tax incentives as of 31 Dec 2023—a useful baseline for growth. MAS

Housing policy: To protect local affordability amid wealth inflows, the ABSD for foreigners buying any residential property was doubled to 60% (27 Apr 2023)—a signal that Singapore seeks quality over volume in capital inflows.

Italy (Milan)

New-resident flat tax: Italy’s regime for new residents—substitute tax on foreign income—was doubled from €100k to €200k for new applicants via decree in Aug 2024, applicable going forward. This keeps Italy competitive while trimming perceived generosity. (Reuters)

Luxury retail gravity: Via Montenapoleone is now the world’s most expensive retail street by rent, reflecting deep luxury demand—a magnet for top-end wealth ecosystems. Cushman & Wakefield

Monaco

Price point: Monaco remains the pinnacle of prime pricing; average resale prices reached €51,967/m² in 2024—a fresh high and testament to scarcity plus tax stability. content.knightfrank.com

Bottom Line

These hubs don’t just offer lower headline taxes; they are deliberately building legal and market infrastructure tailored to the governance, philanthropy, and multijurisdictional needs of family capital.

Signals from the market (not just policy)

Dubai residential:

Broad-based uptrend through 2024 for apartments and villas; villas particularly strong—consistent with relocation of end-user UHNW families, not just investors. Zawya

Monaco prime:

New highs on € per m² reinforce the principality’s role as a “safety premium” rather than a speculative trade. content.knightfrank.com

Luxury retail in Milan:

Rental benchmarks on Via Montenapoleone illustrate the concentration of discretionary-spend ecosystems outside London. Cushman & Wakefield

Why this matters

Tax predictability and duration:

Four-year UK relief versus longer-dated regimes elsewhere changes household calculus for education, philanthropy, and succession. GOV.UK

Regulatory certainty:

Purpose-built frameworks in DIFC and calibrated SFO regimes in Singapore reduce friction when deploying capital. dfsaen.thomsonreuters.com; mas.gov.sg

Currency and market access:

Post-Brexit frictions for servicing EU clients from London (mitigated, but not erased, by equivalence) encourage multi-hub setups. House of Commons Library

Caveat: Public filings and statements determine what can be asserted with confidence. This analysis does not speculate on any individual’s current residence or unannounced business moves; it uses the case to illustrate the broader portfolio-of-jurisdictions approach now common among UHNW families. Readers should treat unverified relocation claims with caution and consult primary sources.

What the UK still has — and what it must solve

Enduring advantages:

- Depth of markets for GBP, global ECM/DCM, and alternatives

- English law and courts

- Time zone bridging Asia and the Americas

- Education, culture, and professional services networks

Pressure points:

- Tax competitiveness: The new FIG regime is simpler and arguably fairer—but shorter in duration than regimes used by rival hubs. GOV.UK

- Market access: Without passporting, London must refine bilateral and regulatory cooperation to preserve wholesale scale. House of Commons Library

- Narrative discipline: Policymakers should rely on official data and fiscal costings, not headline “exodus” tallies, to calibrate reforms—and communicate certainty. Financial Times

Definitions

- HNW/UHNW: Labels vary by source; treat thresholds as heuristics, not bright lines.

- Non-dom vs. residence-based regime: Pre-2025 UK rules relied on domicile concepts; now relief hinges on years of non-residence and a four-year FIG window. GOV.UK

- SFO: Single-family office—structures and permissions differ by jurisdiction; Singapore provides clear incentive pathways and counts only those SFOs granted tax incentives when quoting official figures. mas.gov.sg

What to watch (H2-2025 to 2026)

- UK implementation guidance and transitional complexities around the FIG regime. GOV.UK

- EU–UK financial dialogue outcomes on equivalence and clearing. House of Commons Library

- UAE follow-through on D33 (licensing throughput; court capacity; dispute-resolution metrics). UAE Government Portal

- Singapore SFO policy calibration and AML safeguards; whether the official SFO count continues to rise. mas.gov.sg

- Italy’s flat-tax durability at €200k and any tweaks in scope or eligibility. Reuters

Reader FAQs

Q: Are headlines about “15,000+ UK millionaires leaving in 2025” reliable?

A: Treat them as directional. Recent FT coverage and independent analysis question methodology and sourcing. We use official fiscal data and policy costings to judge impact. Financial Times; Tax Policy Associates

Q: Is London “over” for the ultra-rich?

A: No. London’s fundamentals remain world-class. But for some globally mobile families, duration and predictability of relief elsewhere tip the scales.

Q: Why do Dubai and Singapore keep coming up?

A: They pair low or targeted taxes with fit-for-purpose legal frameworks for family capital (succession, governance, philanthropy), and they market those frameworks clearly. dfsaen.thomsonreuters.com; mas.gov.sg

Compliance notes & source transparency

- Brexit market access: UK lost EU passporting; equivalence is narrower. House of Commons Library

- UK tax reform: Residence-based regime with four-year FIG relief from 6 April 2025. GOV.UK

- UAE policy: No personal income tax; D33 growth agenda. UAE Government Portal

- DIFC framework: 2023 Family Arrangements Regulations in force. dfsaen.thomsonreuters.com

- Singapore: 13O/13U and PTIS; ~1,400 SFOs with incentives as at 31 Dec 2023. mas.gov.sg

- Italy: Flat tax doubled to €200k for new applicants (Aug 2024). Reuters

- Property market markers: Dubai 2024 residential +19% (broader market); Monaco resale average €51,967/m² in 2024. Zawya; content.knightfrank.com

Data caveats: Press-release stats and consultancy estimates are indicators, not audited national accounts. Treat with appropriate caution. Financial Times

Latest In Media & marketing

Banking Magazine

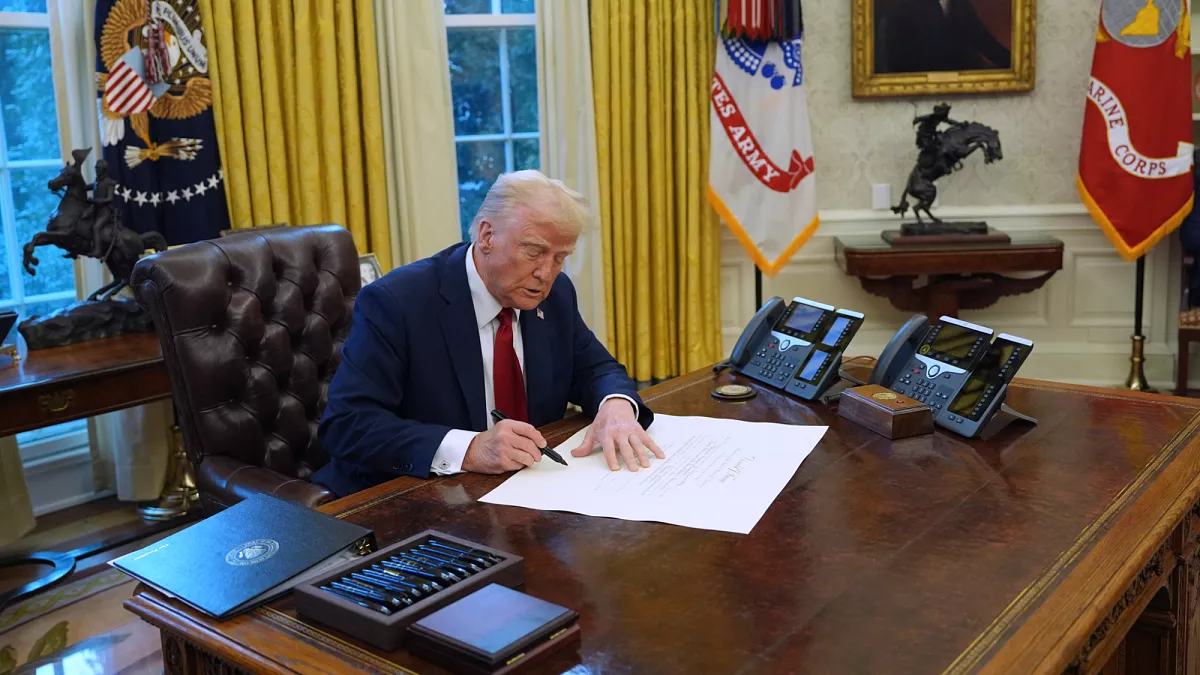

Investing Amid Volatility in Trump’s Second Term

Investment

Investment Strategies in the USA: Adapting to Policy Shifts

Finance

Stock Market Trends: The Impact of U.S. Investment Regulations

Money